GMRgold is a Global Leader in All Aspects of Precious Metals IRA’s and 401K’s

Adding some physical gold and silver to your portfolio with help to protect your savings during these volatile times. The IRS has a list of approved storage depositories. With a low annual management cost and a reputation for good customer service, Lear Capital is a great option for individuals interested in a precious metals IRA. The company relies on third party depositories to store your gold, and the depositories it uses are Brink’s Global Services USA, Inc. There are plenty of ways to diversify but investing in gold is becoming a new favorite among risk averse investors. A: Gold IRAs can be a worthwhile investment option for investors looking to hedge against inflation and economic uncertainty.

Gold IRA FAQ

A number of vaults that offer https://www.outlookindia.com/ allocated storage will also give you the possibility of having segregated storage instead if you request it, but it will likely cost more. GoldCore offers to buy back your gold or silver at very competitive prices. In the United States, the purity must be 0. Palladium bullion coins such as Canadian Maple Leaf bullion coins, and more. An “IRA” is an “individual retirement account”. In fact, a majority of Regal Assets’ business pertains to offering IRA rollover services. If they do not take legal custody, they are not held liable if anything happens to your investment. Prior to linking to this site, you must first obtain FFR’s written permission. However, by comparing the services and offerings of Augusta Precious Metals, American Hartford Gold, Oxford Gold, and Lear Capital, investors can make informed decisions and select the company that best fits their investment goals and needs. It would help to establish what you want to get, research the companies, then decide. This does not mean that a custodian makes any purchases on behalf of the client or is in any way responsible for the SDIRA to meet IRS requirements. Consumers should be alert to claims that customers can make a lot of money in these or any investment with little risk. Choose your precious metals dealer, decide which items you want your account to buy, complete the necessary paperwork, and execute the purchase. They’ll need to make sure that all assets are really yours and that they are traceable.

Create an Account

This is to ensure the metals are being held securely and to prevent any potential tax issues. A rollover or direct transfer is a non taxable event. At Madison Trust, you get a direct line to a dedicated Self Directed IRA Specialist who’s there to maintain your account and answer any questions you might have. What forms of payment are accepted. Your IRA custodian will be the one to submit the form, and the process may take up to 10 days. Reading reviews is great. Advantage Gold, on the other hand, offers clients a variety of gold and silver investment options, as well as educational resources to help clients make informed decisions. And you’re not restricted to only certain IRS approved gold. At your request, you are being redirected to a third party site. Gold doesn’t have the returns potential as stocks.

Approved Precious Metals in a Gold IRA

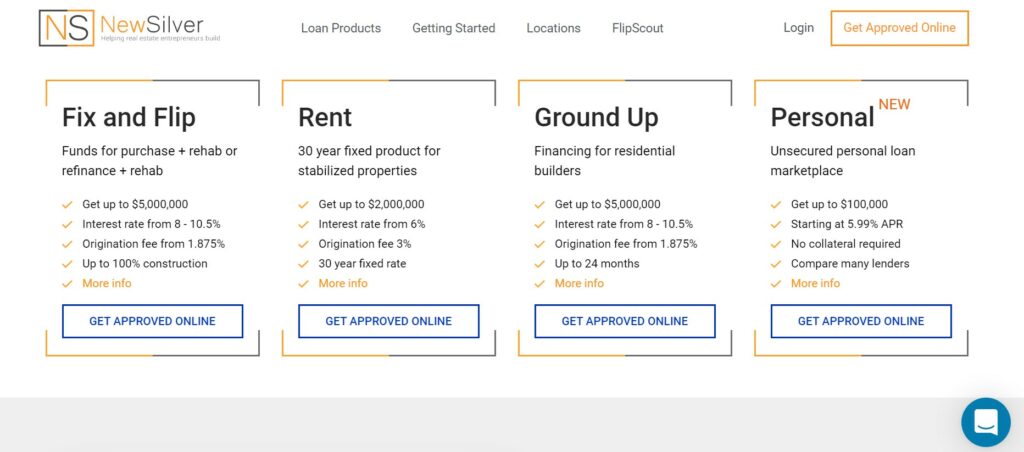

Silver is an essential element in the creation process of many products, so it’s unlikely to lose its value. The Oxford Gold Group has been in operation since 2017 and specializes in gold and precious metal IRAs, as well as gold, silver, platinum, and palladium home deliveries. If you’re considering a precious metals IRA, check out our Gold IRA guide. New Silver’s pool is the first in the world to be approved for leverage by MakerDao, the leading DeFi protocol with $15B of assets. Retirement Investments has advertising relationships with some of the offers listed on this website. And then think critically about your reason for wanting to buy and whether this will actually accomplish what you are looking for. With well established hallmarks, are acceptable as well. Experience the Brilliance of Oxford Gold Group. Click Here for Free Gold IRA Kit. Experience the Quality and Value of Augusta Precious Metals Today. Donna made a last ditch attempt to argue the text of the IRC permits her to personally hold gold and silver coins and retain the tax deferral offered by her IRA.

Secure Your Financial Future

This process allows individuals to diversify their retirement portfolio and gain exposure to the potential benefits of gold investing. In summary, the process for a silver IRA rollover involves finding a reputable precious metals dealer, opening a new IRA silver account, initiating a rollover from an existing retirement account, and selecting IRA approved silver products to add to the new account. Additionally, American Hartford Gold Group provides a secure and reliable platform to store gold and silver investments. Yes, however, your spouse would need to waive their rights by signing a release on the application. Disclaimer: This material is partially funded by a sponsor. Other firms offer IRAs based on various cryptocurrencies like bitcoin. Their dedication to providing the best gold IRA services, combined with their competitive pricing and customer service, makes Birch Gold Group one of the best gold IRA companies available. As of today, Noble Gold offers both coins and bars in silver, gold, palladium, and platinum. Edited by: Lauren Hamer. GoldCo is dedicated to providing the best silver IRA services and products to its customers.

IDF to probe terror killing of three Israeli soldiers by Egyptian policeman

The process of setting up a gold IRA with Noble Gold Investments is fairly straightforward. Their knowledgeable staff are always available to answer questions and provide guidance to ensure customers get the best possible silver IRA. As a custodian, NDTCO does not sponsor, endorse or sell any investment and is not affiliated with any investment sponsor, issuer, or dealer. Is it a good idea to invest in gold coins and bars. With a silver IRA, you can purchase physical silver coins and bars, or you can purchase silver ETFs or mutual funds. While it might be convenient to be able to see your gold at all times, you may not want to store it in your home. Moreover, its precious nature offers an intrinsic market value given the rarity, distinctiveness and innovative uses in electric vehicles or green technologies. An online educational portal is accessible through the eToro Academy. Therefore, the company has earned positive reviews and comments. Its online resources include current market news, videos led by its on staff Harvard trained economist, and a required minimum distribution calculator. Invest in Your Financial Future with Birch Gold Group Today. Required fields are marked.

GoldCo: Rating Silver IRA

First Fidelity Reserve recommends a hold time of five to ten years or more. You’ll pay a $200 annual fee for Lear to manage your IRA. The representative we spoke with informed us that there would be a flat, $180 annual fee once the account was opened. ITrustCapital lets you invest in silver through a self directed IRA. Find a reliable silver IRA custodian today and begin preparing to invest in precious metals. They might, for example, recommend gold and silver custodians or deals. Subscribe to get complete access to Outlook Print and Digital Magazines, Web Exclusive stories and the Archive. It currently allows for rollovers from traditional IRAs, Roth IRAs, SEP IRAs, SIMPLE IRAs, 401ks, 403bs, 457bs, and other accounts. Kiavi simplifies the lending process by eliminating paperwork like appraisals and income verification.

RC Bullion: Pros Silver IRA

This fee includes insurance, storage, and access to an online account. This includes recommendations for IRAs or leveraged purchases that come with expensive monthly fees for administration, handling, storage, or insurance; purchasing collectible coins with high markups and low liquidity; and tapping retirement savings, which is where many Americans hold the bulk of their investment assets. Discover the Value of Investing in Augusta Precious Metals Start Today. Discover the Gold Standard in Quality with GoldCo. The solution is passive income. One of our Gold IRA Dealers will help guide you through the easy process of converting or starting a new gold IRA. It’s always a good time to check if your health insurance policy is good value for money and that you have the right level of cover for your needs. We’ve put together this detailed review as your guide to making an educated decision. Once reach 59 1/2 years of age you can take possession of the gold and pay any tax or sell the gold and liquidate your account to get cash.

Customer Ratings

However, Augusta Precious Metals walks with you hand in hand throughout the entire life of your precious metals portfolio. Precious metals offer a compelling alternative investment opportunity. GoldCo has a long standing reputation for providing quality products and services. Nonetheless, there is one central flaw when it comes to this company. To say he was honest and helpful would be an understatement. Upon receiving this confirmation from Delaware Depository, we will update your account accordingly. American Hartford Gold Group also offers a range of educational resources to help customers understand the benefits of investing in a silver IRA. The company has a team of experienced professionals who are knowledgeable about the gold and silver markets and can provide valuable advice to their clients. Red Oak Capital ships insured all metals directly to the Delaware Depository Service Company DDSC, one of America’s largest precious metals depositories. During this initial call, you will speak with an agent who will explain the basics of an IRA and answer any questions you may have. Our custodians are more than happy to help you with a transfer or rollover in the seamless and correct manner.

BUY SELL TRADE

RC Bullion is a trusted leader in the silver IRA industry. He knew exactly what I wanted. Augusta Precious Metals is one of the best gold IRA companies in the industry. STRATA is a wholly owned subsidiary of Horizon Bank in Austin, Texas. We follow your wishes. Both physical bullion and a gold and silver IRA offer true diversification, solid protection, and excellent profit potential for any portfolio.

2020 Silver North American Bald Eagle 1 5 oz

Morgan Asset Management. Their gold and silver IRA investments are backed by a guarantee of full repayment if the customer is ever unhappy with the results. A broker or custodian is a crucial component of the process because they are the ones responsible for purchasing and storing the gold on behalf of the investor. Furthermore, the global government debt is skyrocketing, and this means, the dollar cannot be considered a reliable store of wealth, and this is why more and more banks are storing gold in their vaults instead of cash. A gold IRA provides a range of investment options in IRS approved precious metals, including gold, silver, platinum, and palladium. Invest in Your Future with Noble Gold’s Superior Precious Metals Solutions. Can You Retire Comfortably. A: Investing in a Silver IRA can provide diversification for your retirement portfolio, potentially protect your wealth against inflation or market volatility, and provide a safe haven for investors during times of economic uncertainty.

Buyback Program

Some are looking for IRA investments. Therefore, customers will have to pay if they want to open an account. Basically, we followed our own buying tips to uncover the best providers. Historically offers a hedge against stock market volatilityProtects against the devaluation of the dollarSignificant performance in an inflationary environmentProtects against possible government retirement account Bail In. Silver Cloud Financial, Inc. The Patriot Gold Group makes our list of gold IRA providers because it delivers direct to consumer pricing, saving investors typical middle man fees, all while providing top notch customer service and consumer satisfaction. Extensive educational resources. December 26 0 comments. Madison Trust’s Self Directed Gold IRA gives you the freedom to do just that. However, you should keep in mind that you need to invest your money in physical silver in order to earn capital gains. Investing in numismatic coins can be a bit riskier, but there’s also greater potential upside potential if you purchase numismatic coins at the right time and at the right price. But just about any conventional IRA, whether Roth or traditional, can be converted to a self directed account. They also sell pre created Royal Survival Packs ranging from $10,000 to $500,000.

Advertising

Customers will have to determine if its experts are knowledgeable and have the necessary expertise to guide them through the process of creating and investing in silver IRAs. If you’re considering investing in a gold IRA, be sure to do your research and choose a reputable company to work with. $10,000 account minimum. The company has a long standing reputation for its expertise in silver investments and offers a wide range of silver IRA options. He’s written financial content for firms of all sizes from boutique investment banks to the largest real estate investing publication on Seeking Alpha. They can provide guidance on the https://www.reviewjournal.com/bp/business/top-10-gold-ira-companies-secure-your-future-best-ira-accounts-for-gold-investing-in-2023/ types of gold that can be held in the account, the fees associated with the account, and the process for purchasing gold. Silver can be used as a protectionary measure in times of economic uncertainty. Open an account online in under 10 minutes here. You can rollover or transfer funds from any existing IRA, 401k, 403b, and 457b accounts, or you can contribute directly to the account — up to $7,000 per year, depending on your age. With this behavior, Red Rock Secured clients will be more comfortable asking questions regarding precious metal individual retirement accounts as the financial team guarantees they will listen. As members, this shows our good standing with our peers in the numismatic industry. Potential customers have the option of spending all the time they need on the company’s official website, browsing educational content, and obtaining the information they need before contacting a representative to open an account. Made possible by the Taxpayer Relief Act of 1997, a gold IRA is a type of long term retirement account in which a custodian holds precious metals for the account owner. Online application, instant eligibility check1, 48h funds transfer2: we do everything we can so that any time is the right time for you.

Advertising

The metals are legally documented and inaccessible to workers. Unlike traditional account types, IRAs allow people to invest in physical precious metals. Another option is to transfer cash into the self directed gold IRA to fund your purchase. With its commitment to providing a safe and secure gold investment platform, GoldBroker is a top choice for those looking to diversify their retirement portfolio with gold. They must be stored by the IRA custodian in an IRS approved depository. Gold bullion is used as a reserve currency for many governments. All gold IRA rollovers must follow the same tax rules for funds rolled into a traditional or Roth IRA. Experience the Difference with Advantage Gold. A: To open a gold and silver IRA, you must first find a custodian who specializes in self directed IRAs that allow investments in precious metals. The precious metals that can be stored in a precious metals IRA are gold, silver, platinum, and palladium, and can come in many forms such as bullion coins, small bullion bars, and proof coins. Technically, they can, but they shouldn’t.

IndonesiaReview

We recently called a representative from the firm and noted that the individual was knowledgeable and informative. Here are some of the benefits of investing in gold for retirement. Augusta — the 1 choice silver IRA company in this list — pays your fees for up to 10 years, depending on what kind of account you have. This year, we revamped the review process by conducting an extensive survey of customers that are actively looking to start trading and investing with an online broker. Unallocated storage usually costs less than allocated. Suncorp NIB Silver Advantage Plus, $233 per month. GoldBroker is a trusted and reliable choice for those looking to diversify their retirement portfolio with gold and silver.

SEE OUR YELP REVIEWS

“Mark was very courteous and professional, providing clear explanations of the terms and conditions of all of the paperwork. This could not have been a better First Time Homebuyer experience. However, there is an annual service fee of $80 for all accounts along with a yearly storage charge of $150 for segregated storage, which is available for all accounts irrespective of their size. With a commitment to providing top notch customer service and a team of experts with decades of experience, Birch Gold Group is a reliable and trustworthy choice. If you get bad advice from a company, you could end up owing the IRS big time. This conference is available to the public and helps investors understand the ins and outs of investing in gold IRAs. I am extremely satisfied with the service provided by Goldco. LCR Coin is a group dedicated professionals ready to help. Rollover funds to your new self directed IRA account. Not just any silver coin or bars will qualify for a silver IRA account. The company is big on educating its customers.